The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized framework designed to protect cardholder data during processing, storage, and transmission by merchants and service providers. PCI DSS outlines a set of stringent security controls that organizations handling payment card information must implement to mitigate the risk of data breaches and unauthorized access. These controls encompass everything from encryption and access management to network security and monitoring. By adhering to PCI DSS, businesses are able to safeguard sensitive information like Primary Account Numbers (PANs) and ensure they meet the regulatory requirements imposed by payment card brands.

PCI DSS 4.0.1 is the latest update to the standard, replacing version 3.2, which has been in place since 2016. The update includes significant changes, which are necessary due to more advanced cyber threats and more complex payment systems. Organizations must fully transition from version 3.2.1 to 4.0.1 by March 31, 2025.

One of the larger changes in the latest version of PCI 4.0 is the requirements for managing cryptographic keys and certificates. In this guide, we will break down the major changes set to take place in 2025.

Key Takeaways

- PCI DSS 4.0 requirements change the way you manage certificates and keys.

- Implement automated tools to monitor security certificates and create inventories.

- Continue to engage Qualified Security Assessors (QSAs) to review compliance strategies.

- Conduct periodic, regular reviews of cryptographic protocols and cipher suites.

Where PCI and Cryptography intersect

In the payment card industry, cryptography is a critical line of defense against the constant threat of data breaches and unauthorized access. Attackers often target sensitive information like PANs during storage and transmission, exploiting vulnerabilities or misconfigurations to steal data that can be used for fraud. Effective cryptography ensures that even if bad actors manage to infiltrate a network, the data they encounter is indecipherable and unusable. With the increasing frequency and sophistication of cyberattacks, having strong encryption in place is essential for protecting cardholder data from both external threats, like hacking and malware, and internal risks, such as insider misuse or accidental exposure.

Historically, organizations have relied on established encryption protocols to secure data in transit and at rest. However, the sophistication of modern attacks has exposed weaknesses in outdated encryption methods, necessitating the enhancements found in PCI DSS 4.0.

Important changes in PCI DSS 4.0 regarding cryptography

One of the most notable updates in PCI DSS 4.0 is the emphasis on improving key and certificate management. Requirements 4.2.1 and 4.2.1.1 specifically address the need for organizations to maintain a detailed inventory of cryptographic keys and certificates used to protect PAN during transmission over open, public networks.

Requirement 4.2.1 introduces a new mandate: organizations must confirm that the certificates used for PAN transmissions are valid, not expired, or revoked. This requirement is critical as it directly influences the integrity and trustworthiness of the encryption methods used. A compromised or expired certificate can render even the strongest encryption useless, exposing sensitive data to potential interception during transmission.

In addition, Requirement 4.2.1.1 extends the focus on inventory management, requiring organizations to keep an up-to-date record of all cryptographic keys and certificates. This inventory must be regularly reviewed to ensure all keys and certificates remain secure and effective. (Trying to build your inventory? See our blog on building your certificate inventory for PCI Requirement 4.2.1.1)

Requirements 3.5.1.1 and 3.5.1.2 introduce changes to how businesses handle hashing and disk encryption. The shift from traditional hashing methods to keyed cryptographic hashes is a significant move designed to counter advanced cracking techniques. Keyed hashes combine the input data with a secret key before hashing, making it exponentially more difficult for attackers to reverse the hash and retrieve the original data.

Implementing and maintaining cryptographic standards

To effectively comply with these new standards, businesses must prioritize robust cryptographic management practices.

Requirement 4.2.1 mandates that organizations confirm the validity of certificates used for PAN transmissions over open networks. This involves ensuring that certificates are regularly checked for expiration or revocation. Implementing automated tools that monitor certificate statuses can help organizations stay ahead of potential issues, reducing the risk of a security breach due to an invalid certificate.

Inventory management and documentation is also critical. This inventory should include details on key strength, algorithm type, expiry dates, and the specific data each key or certificate protects. Proper documentation supports better decision-making, enabling quick responses to emerging threats and vulnerabilities.

Regular review and compliance checks are essential for staying compliant with PCI DSS 4.0. Organizations should conduct annual reviews of their cryptographic protocols and cipher suites, ensuring they align with current security standards. This proactive approach helps mitigate risks associated with outdated or vulnerable encryption methods. Businesses should also engage in periodic internal audits and assessments to verify that their encryption practices are both effective and compliant with the latest PCI DSS requirements.

Getting ready for PCI DSS 4.0.1

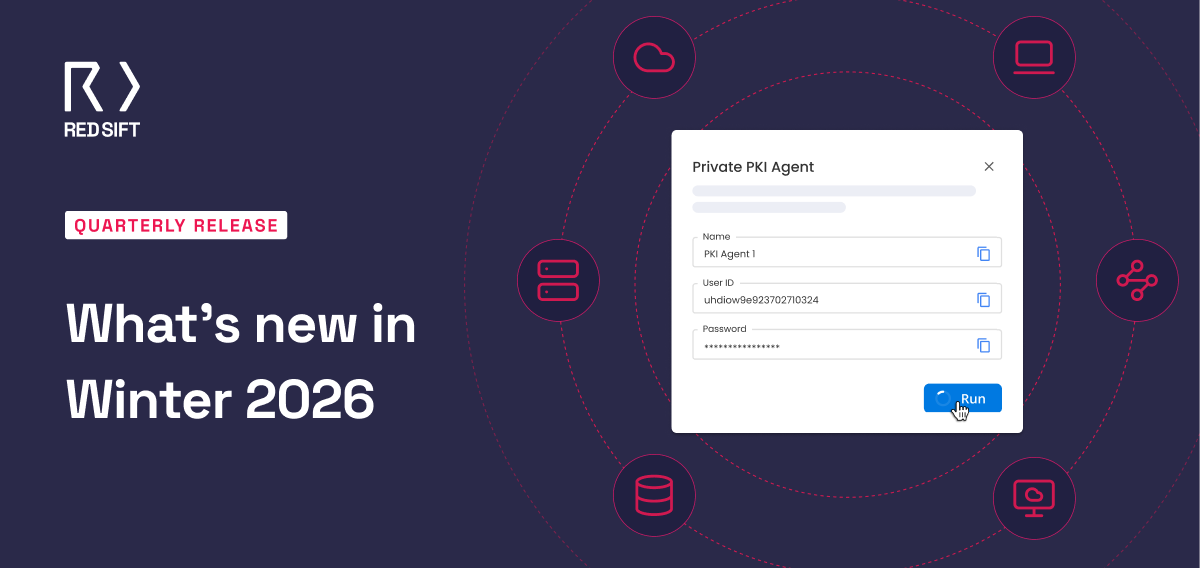

Transitioning to the new cryptographic requirements in PCI DSS 4.0.1 will require careful planning and execution. Businesses may face challenges such as updating legacy systems, retraining staff, and revising security policies to align with the new standards. However, these challenges are necessary investments in maintaining the security of cardholder data.

To prepare for PCI DSS 4.0.1 compliance by March 31, 2025, organizations should start by conducting a gap analysis to identify areas that need improvement. Prioritizing the implementation of automated certificate management tools can help manage the complexities of certificate validation and renewal. Additionally, businesses should engage with Qualified Security Assessors (QSAs) to ensure their compliance strategies are sound and effective.

The enhancements to cryptographic requirements in PCI DSS 4.0.1 reflect the evolving nature of cybersecurity threats and the need for stronger, more reliable defenses. By focusing on the integrity of cryptographic keys and certificates, PCI DSS 4.0.1 aims to close potential vulnerabilities that could be exploited by attackers. For businesses handling cardholder data, these updates not only ensure compliance but also strengthen their overall security posture, protecting both the organization and its customers from the growing threats in today’s digital landscape.

If you have questions about the upcoming cryptographic requirements for PCI 4.0.1, tune in to our on-demand webinar to find out more.